Create accounting adjustments with ease

nettTracker takes the pain out of recording fixed assets, prepaid expenses, deferred revenue, accruals. Creating all the journal entries you need. Hours of time saved, and month-end made easy.

Please watch the demo below (8 mins)

This short video highlights the main features of nettTracker that can potentially save a single company hours of work every month when working towards closing the financial month-end.

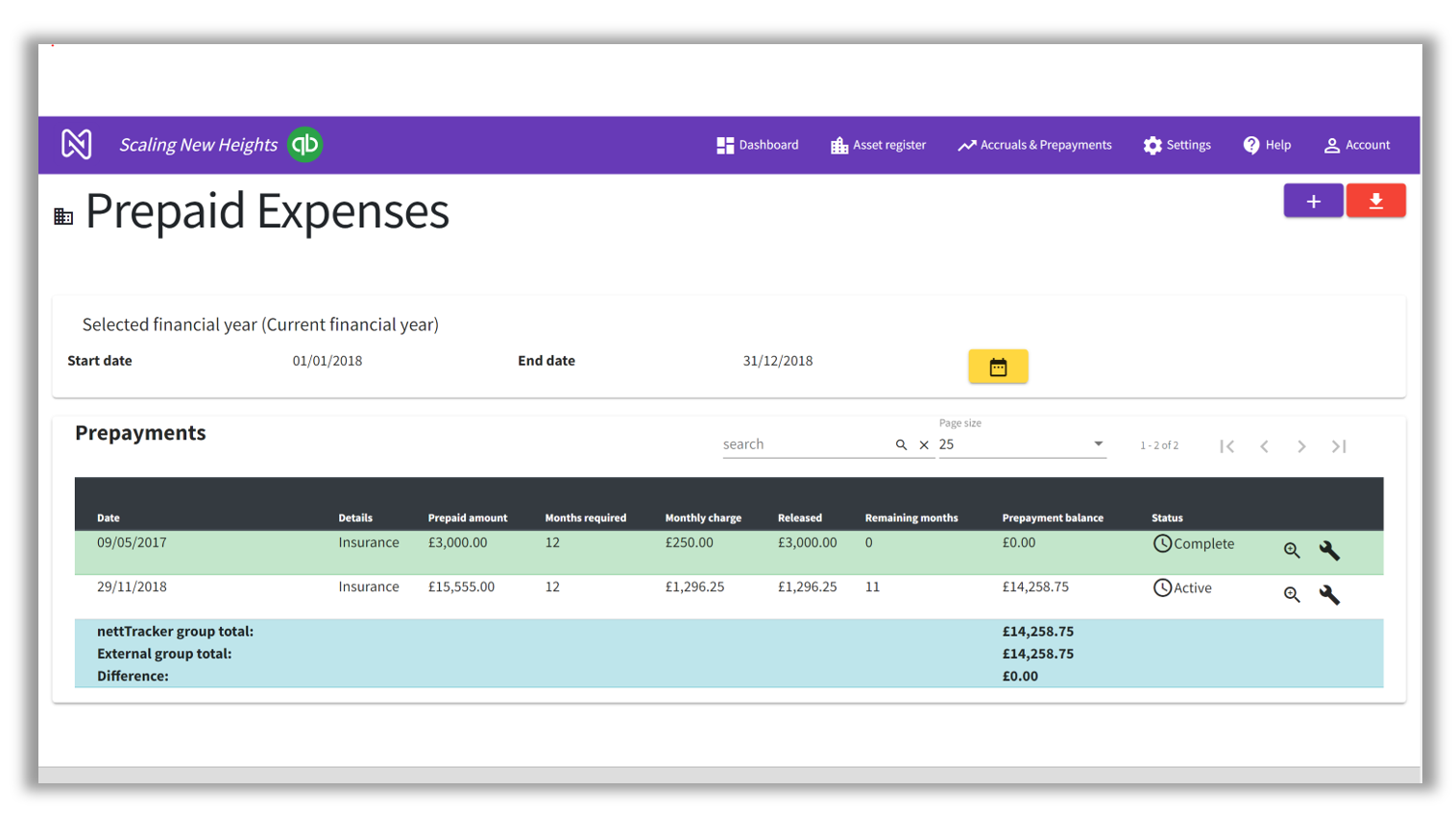

Automated journal entries and statements that look after themselves

Let nettTracker create the journal entries you need each month to keep your books straight, and at the same time update all the statements you need to agree to the balance sheet.

Fixed Assets & Depreciation, Prepayments & Accruals, Deferred Revenue

nettTracker can create all of the journal entries you need, at the same time updating statements that agree to the balance sheet. Spend minutes making adjustments at period end instead of hours.

When it comes to the end of the financial year, all of the hard work has been done for you. Income and expenditure adjusted to the relevant periods. The only adjustment left to make should be one to provide for the amount of tax payable.

QuickBooks Online

nettTracker can be connected to all versions of QuickBooks Online. Used worldwide including; United Kingdom, Ireland, United States of America, Canada, Australia, Africa, Asia.

Xero

If you’ve outgrown the fixed asset register within Xero, or perhaps want to automate your monthly adjustments for prepayments and accruals, nettTracker can provide you with all the tools you need.

Sage Business Cloud

nettTracker can currently be used with Sage Business Cloud in the United Kingdom and Ireland, Canada, and the United States of Amercia. (Sage Business Cloud is the updated version of ‘Sage-One’. If you are unsure of the version you are using, please contact us and we can advise if an integration is possible).

Use ‘Stand-Alone’

nettTracker can also be used ‘stand alone’ if you are not using one of the above accounting software providors. To see how that works, click nettTracker stand alone demo.

Rated 5 stars by users worldwide

nettTracker is used by accountants and businesses in the United Kingdom, United States, Canada, Australia, South Africa, and Asia. If you have an internet connection, you can use nettTracker wherever you are located.

Free trial - no credit card details required

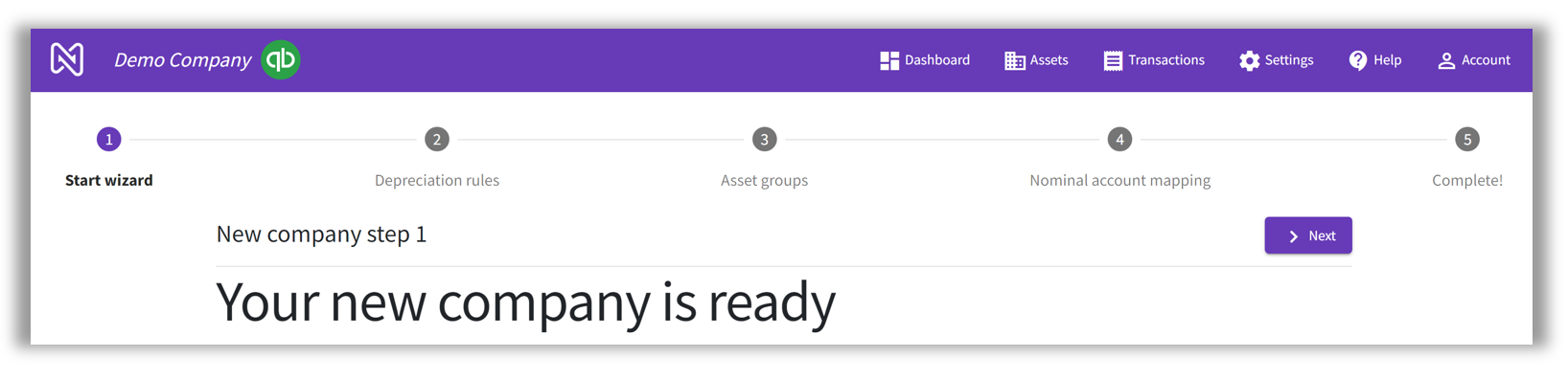

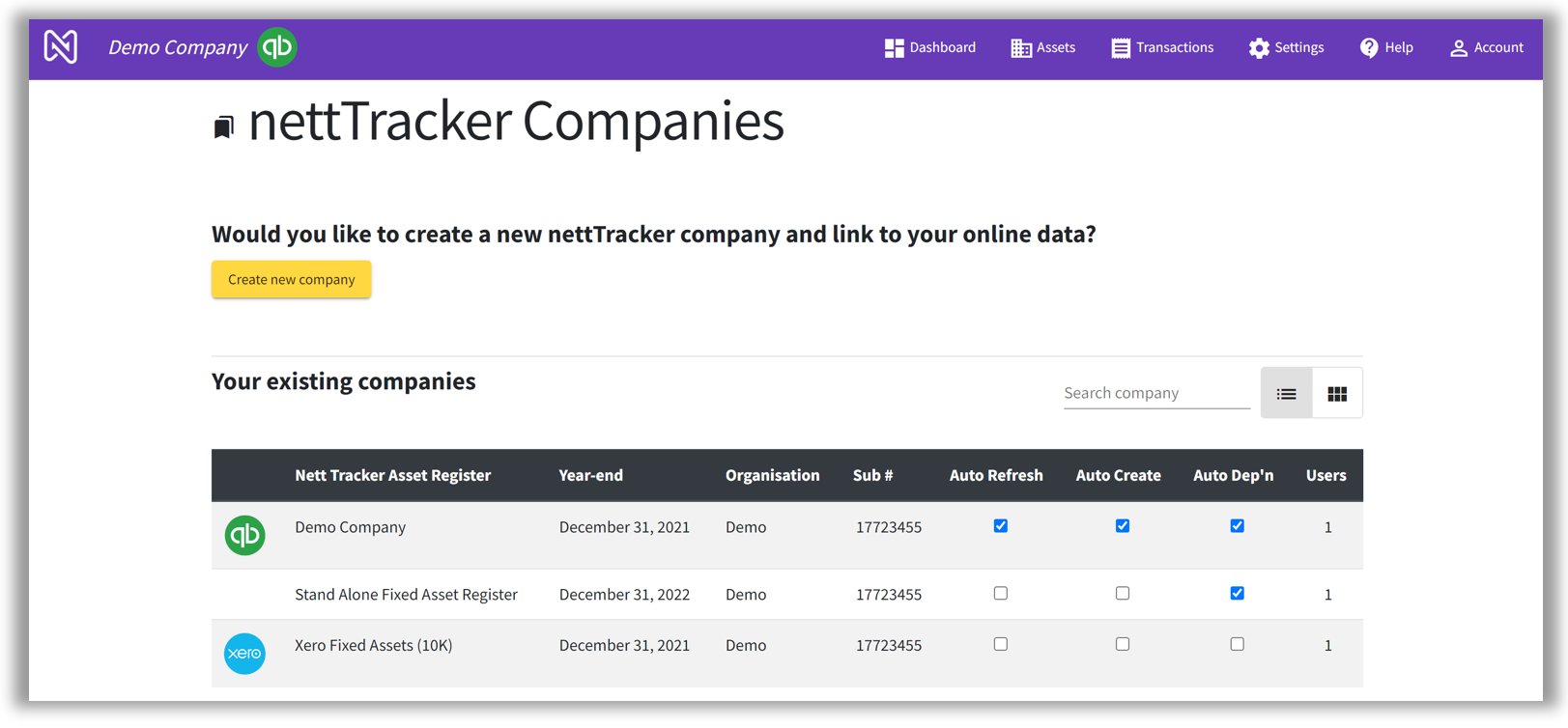

It only takes few mintues to create an account. Once that’s been done you can create a nettTracker company and connect to your accounting software.

Get started in minutes

The set-up wizard means getting started is a breeze. nettTracker takes you through the important settings step by step.

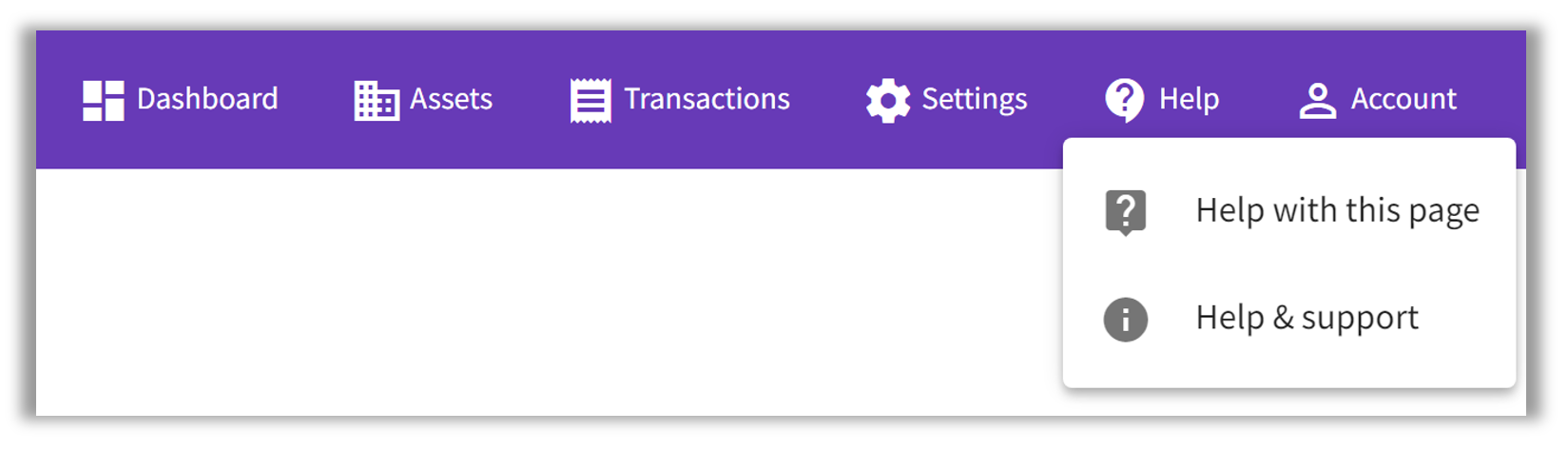

Help is always at hand. A detailed video tutorial is available as well as a regularly updated Knowledge Base and downloadable PDF guides. If you need that extra bit of help, simply raise a support ticket with us.

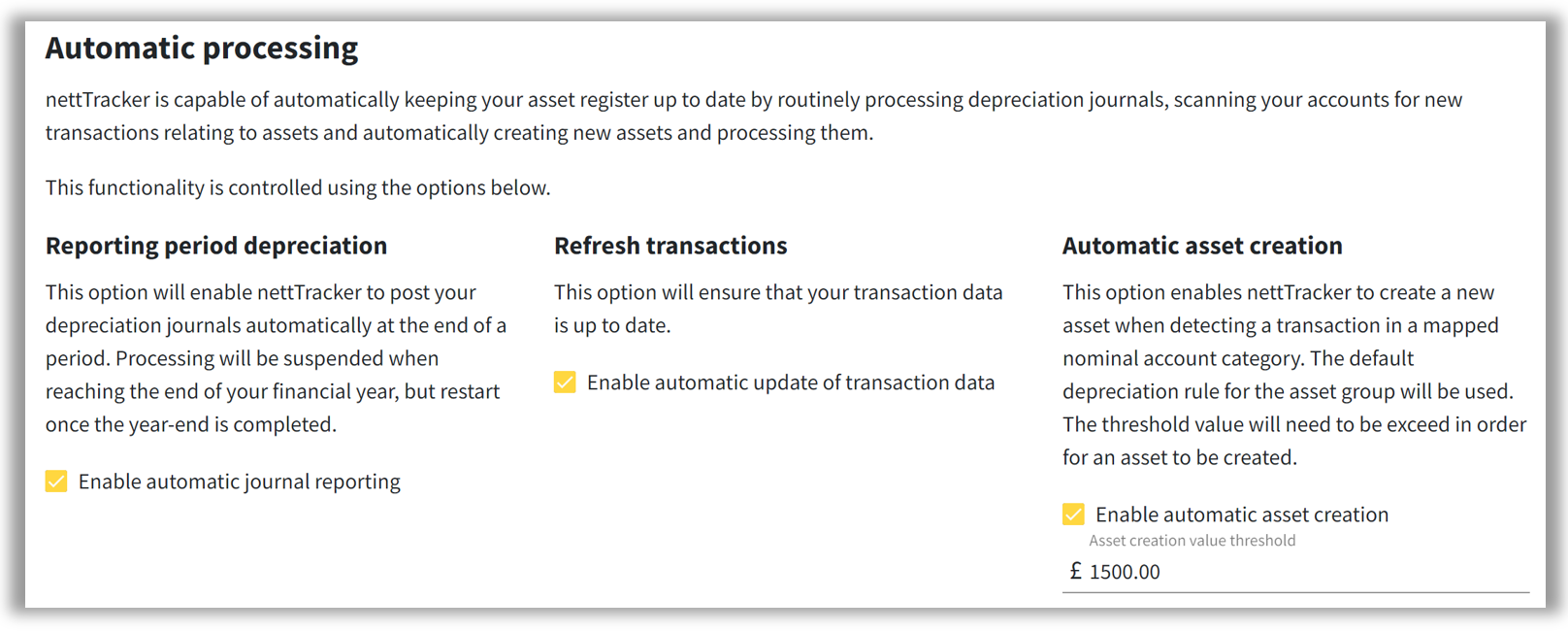

Full automation - ‘set and forget’

With the appropriate settings in place, nettTracker can really look after the fixed asset register for you. Fully automated additions, depreciation calculations and journal postings.

Just log-in periodically to review or dispose assets.

Save time and money

Have you thought about how much time is spent updating spreadsheets and creating manual journal entries during the year? For some businesses this may be an annual task, for others it’s required every month.

With nettTracker working away for you in the background, you have more time available to work on more important and profitable tasks.

For businesses, accountants and bookkeepers

Whether you are an accountant in practice, or an accountant in industry, all the companies you monitor are held in one place.

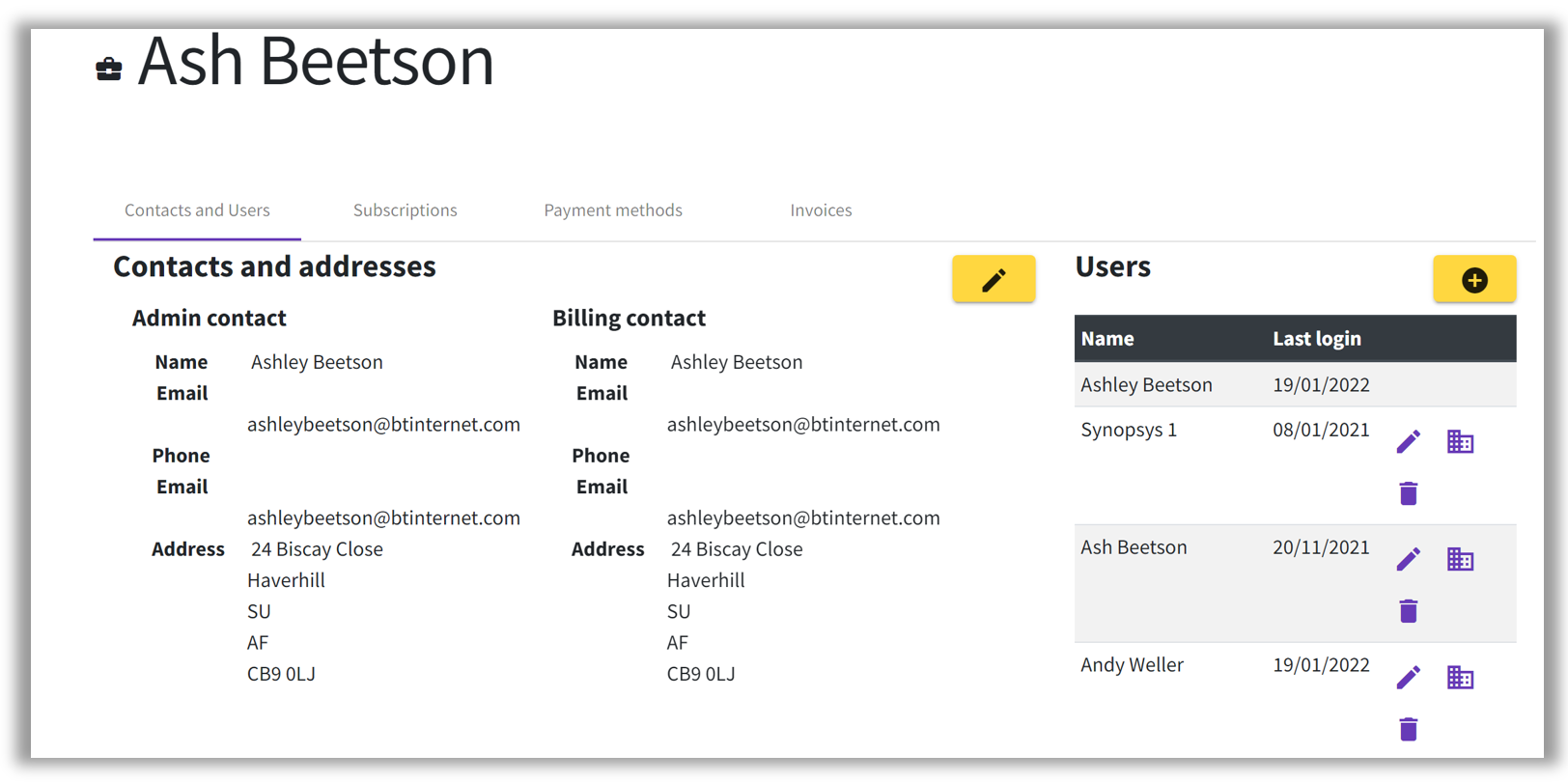

Share with clients and members of your team

nettTracker allows you to invite an unlimited number of users to your organisation. Different user roles are available, and it can be specified which company a user has access to.

Invite members of your team, or invite your clients.